БК Леон: регистрация и идентификация в России

Букмекерская контора Леон одна из первых вышла на легальный рынок компаний, занимающихся приемом интерактивных ставок.

На сегодняшний день БК Леон имеет пункты приема ставок во всех крупных городах России и позволяет делать игрокам ставки на официальном сайте или через мобильное приложение. Контора щедро одаривает своих клиентов вкусными бонусами.

Давайте подробно разберем, что представляет собой букмекерская контора Леон ставки регистрация, как пройти идентификацию, чтобы начать ставить и на какие бонусы могут рассчитывать новые игроки.

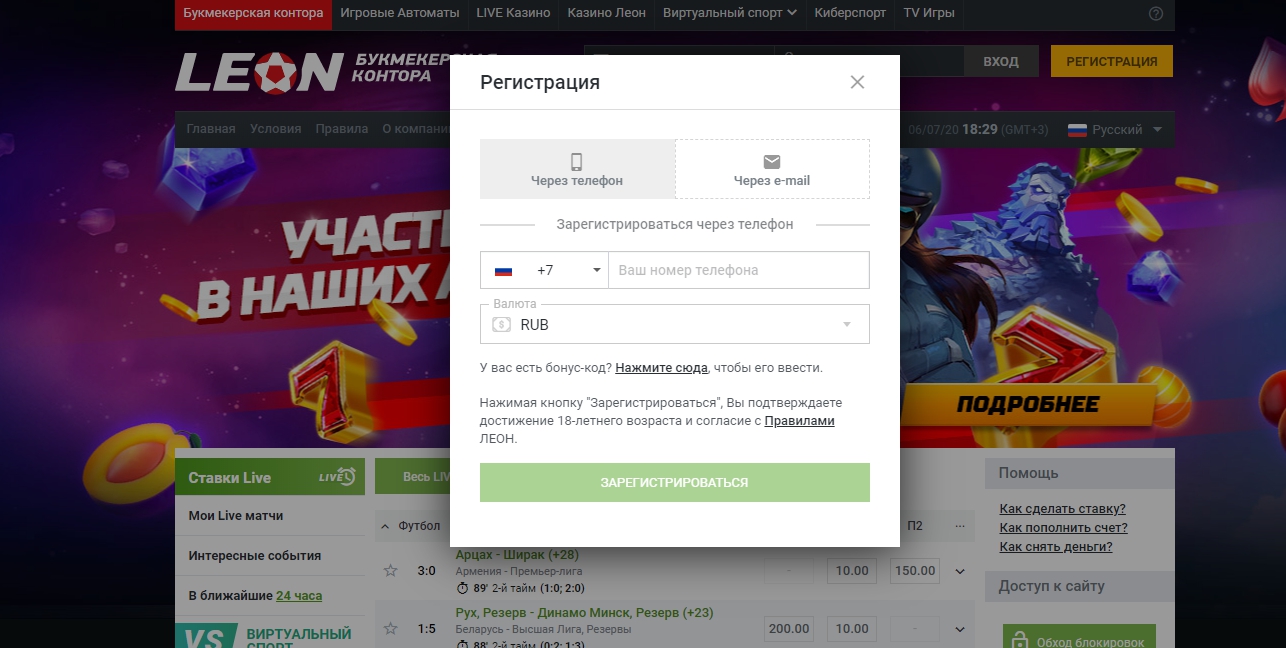

БК Леон: регистрация в России через официальный сайт

В Леон БК регистрация выглядит достаточно стандартно для российского легального букмекера.

На сайте нужно заполнить следующую информацию:

- Данные счета. К учетной записи необходимо привязать электронную почту и телефон. Также пользователь должен задать пароль от личного кабинета. В качестве логина в дальнейшем будут использовать номер счет или указанный email. Также не забудьте указать промокод для получения бонуса.

- Персональные данные игрока. В БК Леон регистрация для нового клиента требует указать:фамилию, имя, дату рождения. Обратите внимание, что к игре допускаются лица старше 18 лет.

На этом регистрация Леон на сайте завершена и игроку необходимо пройти идентификацию.

Однако, тут стоит сделать важное замечание: в БК Леон регистрация и идентификация привязаны к номеру телефона. Если у вас уже есть Киви кошелек с максимальной идентификацией, то указывайте его и следующий пункт можете смело пропускать

Леон Бет регистрация — как пройти идентификацию личности

После того, как вы подтвердили номер на сайте, для вас Леон Бет регистрация формально завершена. Однако, вы не сможете пополнить счет или сделать ставку. Чтобы этот функционал стал доступен необходимо пройти идентификацию личности.

В этом году были введены поправки, которые делают необязательным личное присутствие игрока в пункте приема ставок для подтверждения личности.

На сегодняшний день компания предлагает три варианта прохождения этой процедуры:

- Офисы Qiwi. Они расположены во всех крупных городах России. Процедура для клиентов Леон Бет абсолютно бесплатная. Но не забудьте взять с собой паспорт. Если вы находитесь в Москве, то пройти процедуру идентификации можно в Киви Банке.

- Салоны «Связной». Для подтверждения личности вам также понадобится паспорт. Услуга платная — 300 рублей. Оператор выдаст вам 2 чека на которых нужно проверить правильность заполнения паспортных данных. Артикул услуги — 231695.

- Офисы Contact. Пройти проверку личности можно также в офисах системы денежных переводов. Услуга платная, но ее стоимость ниже, чем в Связном — 150 рублей. Код услуги в системе оператора — QONR. Перед оплатой также не забудьте сверить правильность ввода данных.

Идентификация может занять время, поэтому сохраняйте чеки пока не получите сообщение от системы, что вашему аккаунту присвоен статус «Профессиональный». Букмекерская контора Леон регистрация после этого полностью завершена, игроку открываются весь функционал сайта — он может пополнять счет, заключать пари и выводить выигранные деньги.

БК Леон: бонус при регистрации для новых игроков

Многие букмекеры предоставляют своим игрокам фрибет или деньги на ставки в качестве приветственного бонуса. Но регистрация Леон дает пользователям оба сразу. Сразу после завершения идентификации игрок получит на свой счет 15 бесплатных ставок от букмекерской конторы. Специальных условий на фрибеты нет. Ставить можно на ординары и экспрессы с любыми коэффициентами.

Второй бонус выглядит несколько интереснее. Букмекерская контора Леон регистрация позволяет игрокам получить на счет до 3999 рублей. Размер бонуса равен сумме первого депозита. Для того, чтобы бонусные деньги были перечислены на основной счет их необходимо отыграть.

В качестве отыгрыша принимаются бонусные баллы, которые игрок зарабатывает за все свои ставки. Количество баллов, необходимо для отыгрыша — сумма бонуса деленная на 2. Если мы рассматриваем максимальный бонус, то необходимо набрать 2000 баллов.

Расчет набранных очков производится следующим образом:

- Если ставка выиграла, то беттер получает по одному баллу за каждые 50 рублей чистого выигрыша. Например, вы сделали ставку в 10000 рублей на коэффициент 2,5. В данном случае сумма чистого выигрыша — 15000 рублей. Соответственно игрок получит 300 бонусных баллов.

- Если ставка проиграла. В таком случае пользователь получает 1 балл за каждые 50 рублей номинала ставки. Если брать пример со ставкой в 10000 рублей, то в случае проигрыша игрок получит 200 баллов.

- Если ставка получила возврат. В этом случае такие пари не идут в зачет отыгрыша.

Как только нужное количество баллов будет набрано, пользователь получит письмо на электронную почту. Отыграть бонус необходимо в течение 30 дней после прохождения идентификации.Бесплатный бонус за регистрацию

Этот сайт использует cookie для хранения данных. Продолжая его использование, Вы принимаете политику обработки персональных данных.

Мы начисляем пожизненную комиссию с каждого игрока. Ваш рост доходов будет расти в геометрической прогрессии. Мы понимаем, что сейчас всем важны своевременные выплаты и производим их без задержек.

Для отыгрыша приветственного бонуса понадобится сделать не меньше 20 ставок. Также общая сумма должна превышать размер бонуса в х20. Особенность в том, что зачитываются не только победные, но и проигрышные ставки. Вы вправе сформировать одиночную ставку или экспресс (минимально допустимый коэффициент 1.5).

Регион: Москва

Для участия в бонусной программе от БК «Леон» нужно выполнить следующие условия.

В случае, если «Экспресс дня» оказывается для игрока победным, букмекер автоматически умножает итоговый коэффициент «экспресса» на 1.10 и выплачивает выигрыш по измененному коэффициенту.

Фрибет будет начислен на ваш баланс сразу после открытия учетной записи, но вы сможете им воспользоваться только после прохождения идентификации. Бонусные 500 рублей нужно будет поставить только на экспресс, состоящий из четырех или более событий с коэффициентом не менее 1,50.

1

Мы создали Метарейтинг, чтобы вам не нужно было собирать разрозненную информацию о букмекерах по всему Интернету. Теперь чтобы узнать средневзвешенную оценку той или иной конторы и прочитать все отзывы о ней вам нужно зайти только на один сайт. Metaratings.ru даст вам самые объективные цифры, основанные на данных всех ведущих сайтов о беттинге, а также на отзывах и оценках игроков.

Колби Ковингтон, страховавший титульный реванш Эдвардса и Усмана, провел последний бой в марте прошлого года, в пяти раундах победив единогласным судейским решением Хорхе Масвидала.

Текущие ремонты подразделяются на текущий ремонт автомобиля и текущий ремонт агрегатов, узлов и механизмов.

Щоб встановити додаток букмекерської компанії Leonbets на смартфон або планшет, потрібно натиснути на «Завантажити».

Большой каталог компаний в России, где Вы найдете только актуальную информацию. Мы подскажем Вам адрес телефон, часы работы организации.

Если вы сделали ставку на какое-либо событие, по его окончании система пришлет всплывающее уведомление. Эту функцию можно отключить в настройках. Учетная запись надежно защищена методом двухфакторной аутентификации. Так вы обезопасите свой кабинет от взломов и сохраните выигранные средства.

Google Play Маркет Google LLC · Инструменты

БК «Леон» дарит своим игрокам до пяти фрибетов по 500 рублей за серию ставок на любые киберспортивные события.

Вентиляция по полуоткрытому, полузакрытому и закрытому контуру.

Dagospia H3G SpA · Новости и журналы