Обзор БК Leon.by

Букмекерская контора «Леон» (leon.by) с 1 апреля 2021 прекратила работу в Республике Беларусь. Компания не обновила лицензию, согласно новым требованиям белорусского игорного законодательства. Счета всех клиентов букмекера были закрыты. Вы можете продолжить делать ставки в одной из легальных белорусских букмекерских контор. Также продолжает работу нелегальный букмекер Leon.bet. Обращаем внимание, что он не имеет юридической связи с белорусским оператором.

Полезно знать

Подсказки для новых игроков и не только

Что думают игроки о БК Леон

Оценка игроков 9 / 10

Оценить Высказаться

Игрокам нравится

- Хорошая роспись и линия в прематче

- Высокие коэффициенты

- Удобные разработки для игры со смартфона

- Оперативная выплата выигрышей

Игрокам не нравится

- Проблемы при ставках в LIVE

- Возможные возвраты ставок под разными предлогами

Последний отзыв

- Да Леон средняя контора, но поиграл я у них прилично, неплохая бонусная программа и даже есть возможность всякие ценные призы выиграть, но для этого нужно очень много и успешно играть. Рекламировали их тоже везде где можно, наверно и зарегился у них ради интереса. А так коэффициенты средние и что удивило, одно время не было некоторых видов ставок. Может и не заметил, но просматривал все линии от и до. Ну и проблемы у них одно время были со входом, блокировали что ли, сейчас наконец то это исправили.

Оценить Высказаться

Информация о БК

Год основания

Официальный сайт

№8048/JAZ (Кюрасао)

Валюта счета

белорусские и российские рубли, доллары, евро, тенге, гривны и не только

Мин. депозит

Мин. ставка

Приветственный бонус

300 BYN

Лучшая линия

Выкуп ставки

Возврат налога

Тотализатор

Мобильная версия

Мобильные приложения

iOS,Android

Версия БК для вашего региона

Перейти на сайт БК

Индикаторы букмекера

Надежность

— удовлетворительно

Букмекерская контора «ЛеонБетс» работает по оффшорной лицензии Кюрасао (№8048/JAZ), что автоматически делает ее нелегальной в Беларуси. Многие букмекеры с подобной лицензией имеют не лучшую репутацию из-за частых проблем с выплатами и необоснованных блокировок счета. Впрочем, в случае с LeonBets все относительно надежно — компания работает уже 14 лет.

Подробнее Свернуть

6/10 Superbet

9/10 Игроки

Ваша оценка

Некоторые пользователи жалуются на длительную верификацию при выводе крупных сумм или отказы в выплатах, а также требование загрузить большое количество документов для проверки. Вывод мелких и средних выигрышей проходит без проблем, но с получением серьезных выплат (от пары-тройки тысяч долларов) возможны определенные трудности. По этой причине мы присвоили средний индекс риска БК «Леон».

Важно: Не путайте легальную букмекерскую контору Leon.by и ее офшорный аналог Leonbets с его зеркалами который не имеет белорусской лицензии.

Коэффициенты

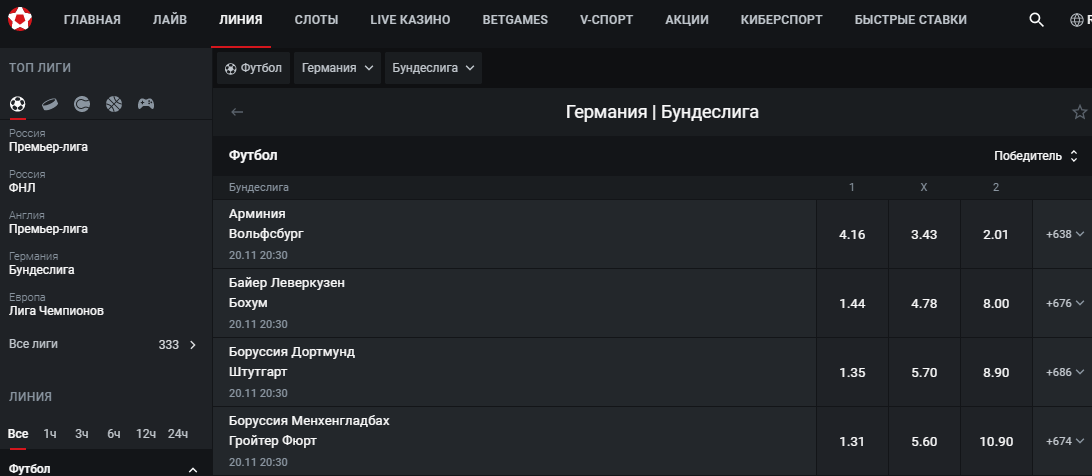

Букмекерская контора «ЛеонБетс» предлагает игрокам лучшие котировки на белорусском рынке наряду с местными букмекерами Marathon и Maxline. Средний уровень маржи здесь составляет 3-5%.

Подробнее Свернуть

9/10 Superbet

9.2/10 Игроки

Ваша оценка

Значения маржи зависят от вида спорта, престижности турнира и выбранного события. Средняя букмекерская наценка на основную роспись топовых футбольных первенств — 2-3%, хоккейных — 4,5-6%, баскетбольных — 3,5-4%, теннисных — 4-5%. Усредненное значение маржи для киберспорта — 6-7%. На равновероятные события букмекер обычно выставляет котировки в пределах от 1.85-1.85 (малозначимые турниры) до 1.93-1.93 (топовые первенства).

Особенность формирования коэффициентов в линии Leon Bet — возможное снижение маржи на 1-1,5% незадолго до начала поединка.

Коэффициенты на основные исходы матчей немецкой Бундеслиги

Традиционно ситуация с коэффициентами в лайве выглядит немного хуже — котировки здесь ниже примерно на 1-2%. Например, маржа на основную роспись чемпионата Японии по футболу составляет 6-8%. Котировки на равновероятные исходы чаще всего не превышают 1.90-1.90, но и не бывают ниже 1.85-1.85.

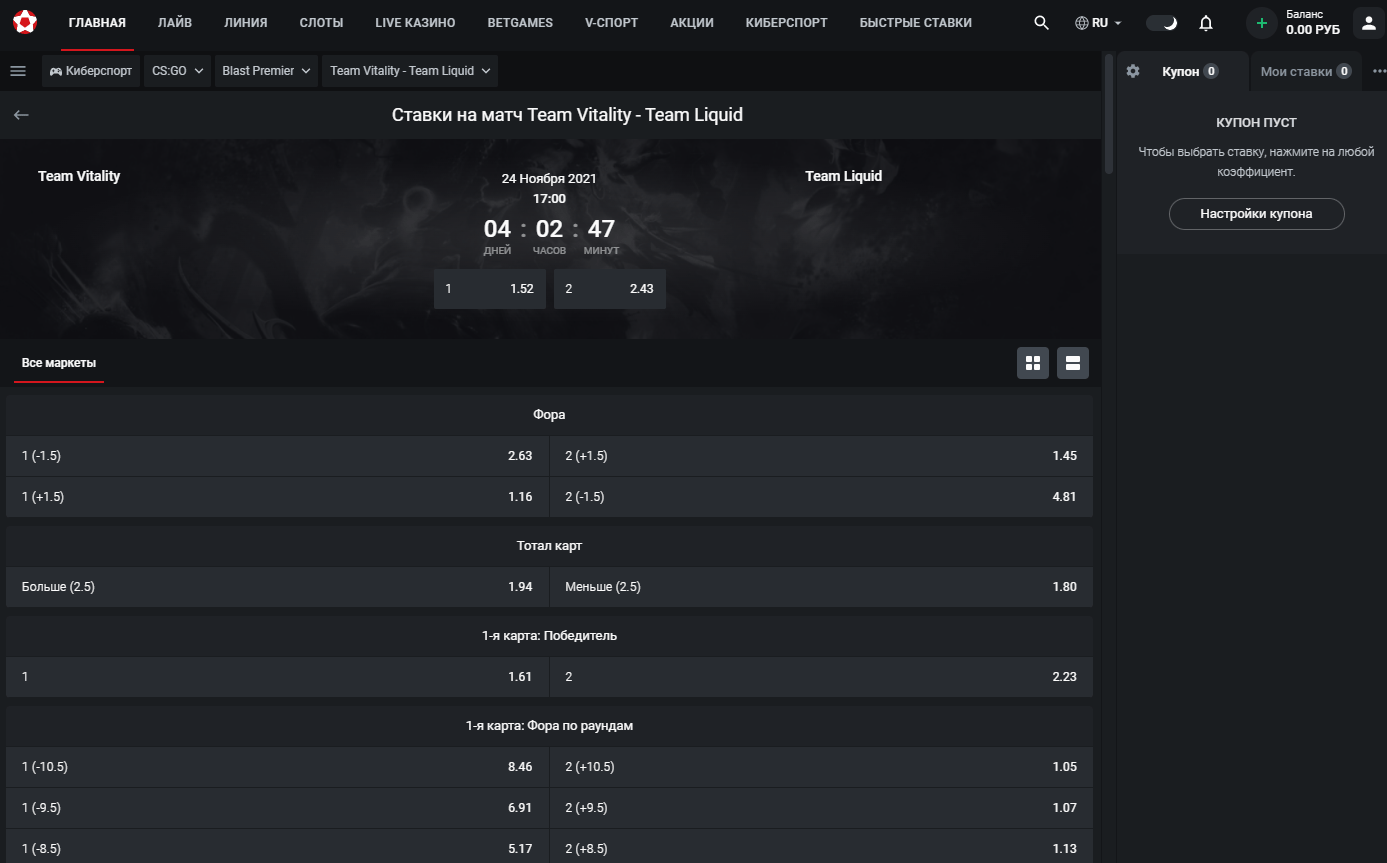

Линия и роспись

«ЛеонБетс» имеет широкую прематч-линию на 30 видов спорта и 5-7 киберспортивных дисциплин. Глубина охвата соревнований достаточно неплохая — до второго-третьего профессионального уровня в зависимости от страны, но есть исключения (например, пять ступеней аргентинского футбола и лишь одна — австралийского). Вариативность росписи на все матчи топового и среднего уровня выше средней.

Подробнее Свернуть

8/10 Superbet

8.8/10 Игроки

Ваша оценка

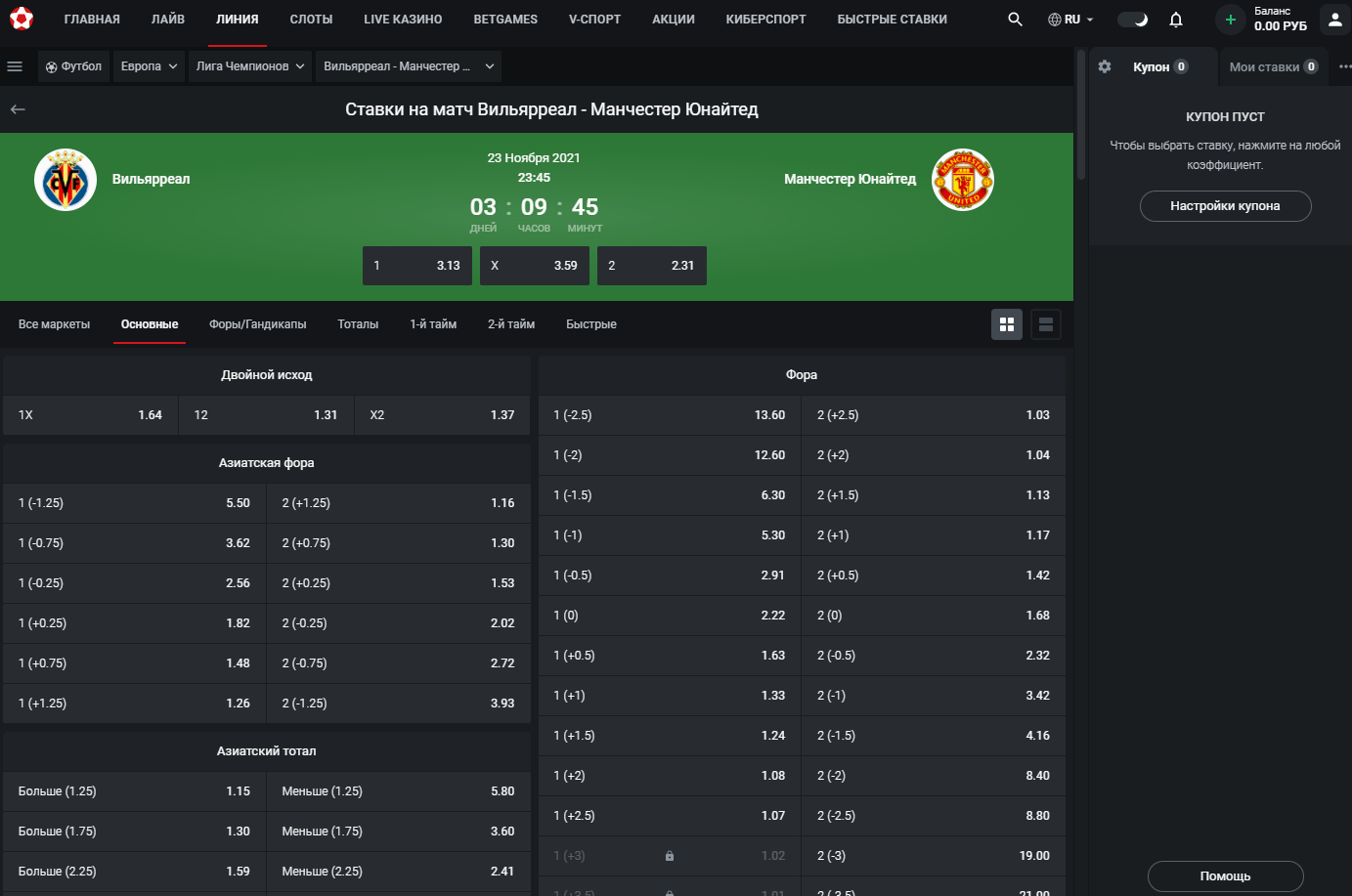

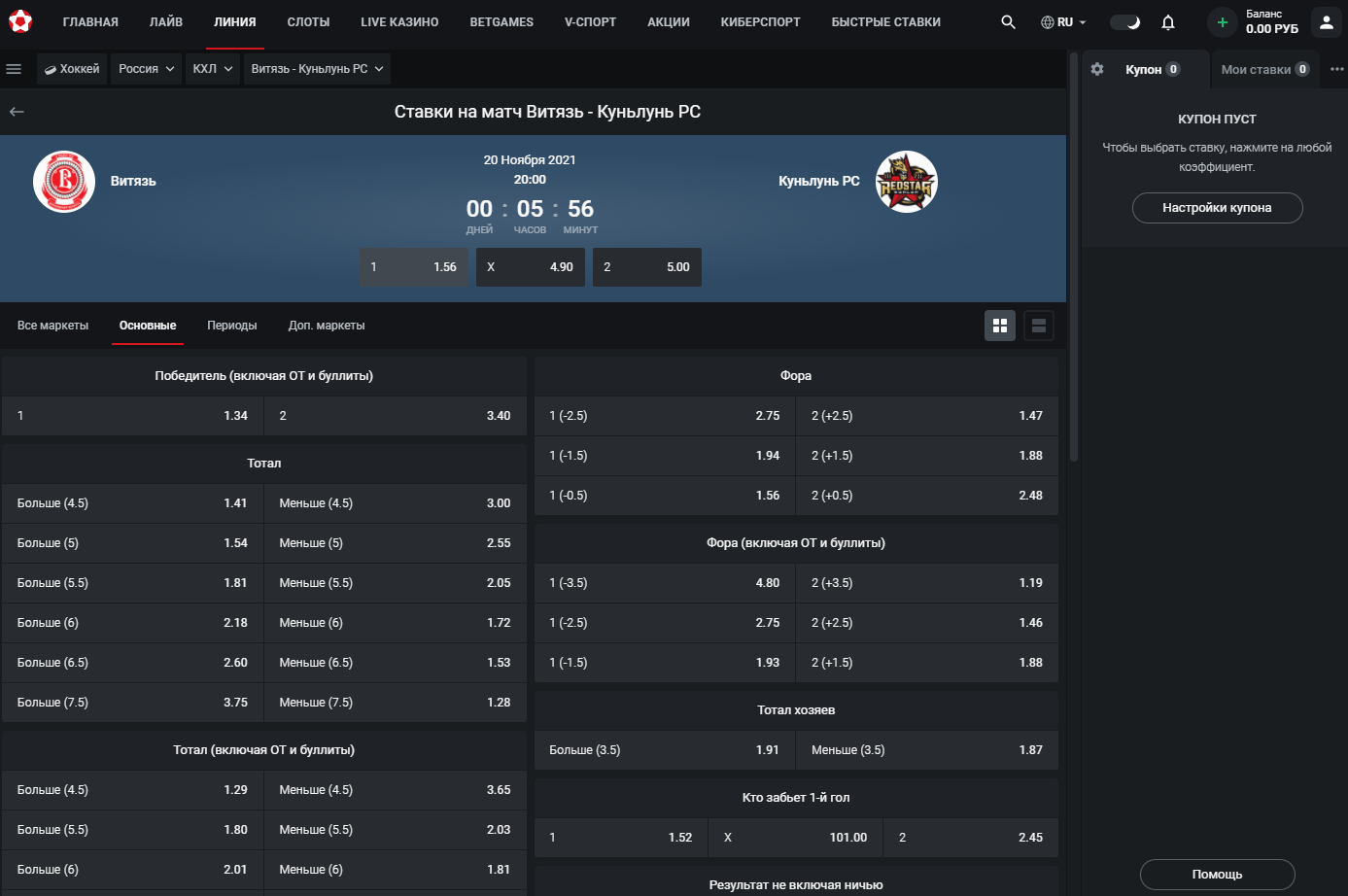

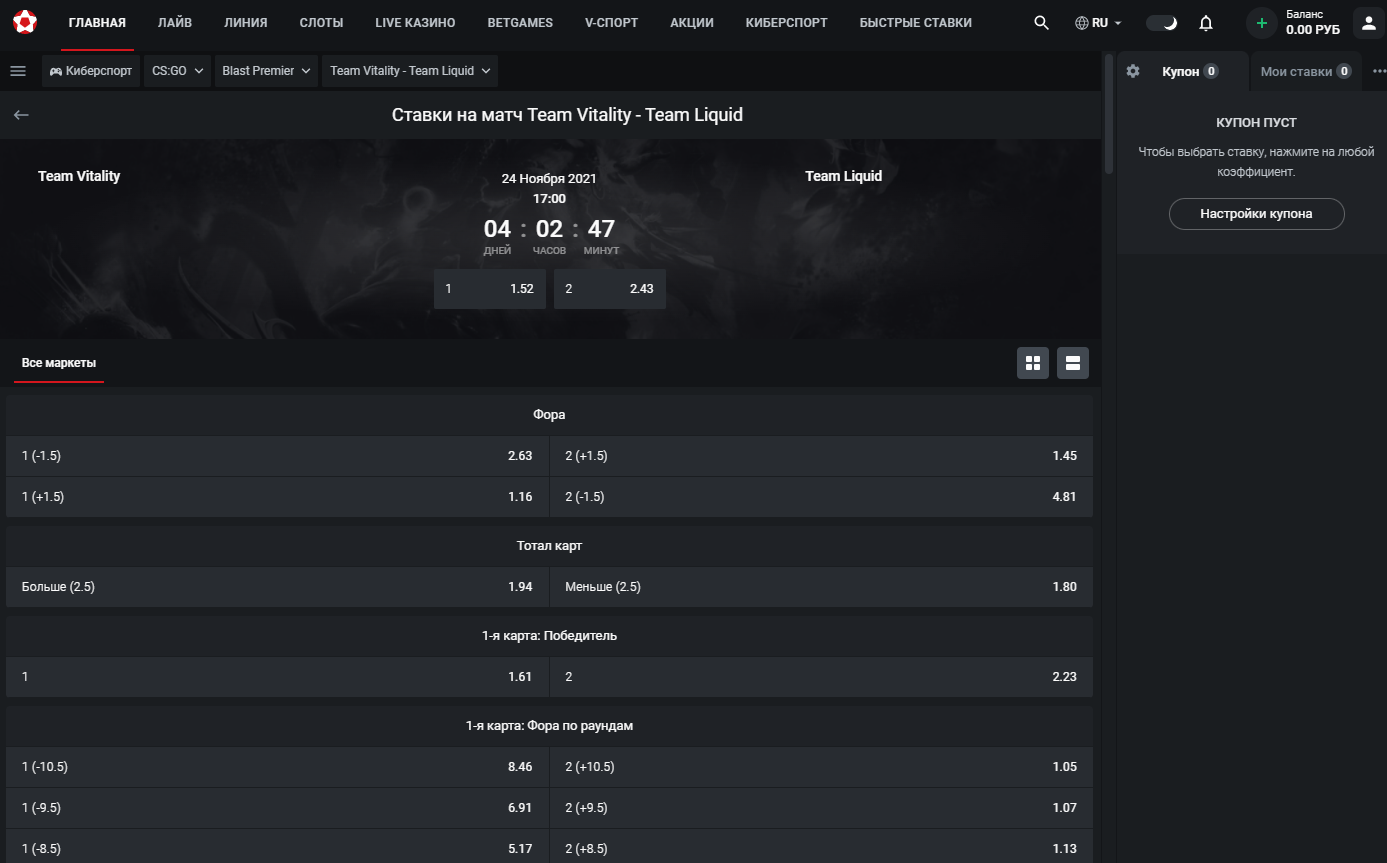

Среди 30 игровых дисциплин в линии есть: футбол, хоккей, теннис, баскетбол, бадминтон, бейсбол, бокс, гандбол, ММА, волейбол, регби и флорбол. Любители киберспорта могут заключать пари на CS: GO, League of Legends, Dota 2, King of Glory, Rainbow Six, Starcraft 2, Valorant и Warcraft 3.

На топовые футбольные матчи выставляется до 700 рынков, а на хоккейные, теннисные и баскетбольные — до 200 маркетов. Пример росписи на поединок Лиги Чемпионов: 1Х2, двойные шансы, тоталы и форы (европейские и азиатские), результаты по таймам, обе забьют, первый гол, точный счет, комбинированные исходы и временные интервалы. В более поздней росписи топ-матчей возможны ставки на угловые, карточки и статистику (удары в створ ворот, офсайды, вбрасывания мяча).

Роспись на матч Лиги Чемпионов

А таким образом выглядит типовая роспись на матч КХЛ: 1Х2, победитель (включая ОТ и буллиты), тоталы и форы (с учетом или без учета ОТ и буллитов), обе забьют, первый и последний гол, наиболее результативный период, результаты по периодам, победитель и тотал, точный счет.

Роспись на поединок КХЛ

В росписи на теннисные и баскетбольные турниры также есть все основные и многие дополнительные маркеты. Как и в большинстве других БК, ситуация с иными видами спорта хуже — зачастую есть только основная роспись.

Не являясь специализированным киберспортивным букмекером, LeonBets предлагает очень подробную роспись на важные турниры по компьютерным играм. Так, в случае CS: GO, Dota 2 и League of Legends это может быть свыше 200 маркетов (победители, тоталы, форы, результаты по раундам и прочее).

Роспись на матч Dota 2

Кроме того, в БК «Леон» можно ставить на виртуальный спорт. Однако рассматривать подобные пари серьезно не стоит — из-за высокой маржи и абсолютной случайности исходов выигрывать здесь на длинной дистанции невозможно.

Линия пре-матч

1/10 Superbet

Ваша оценка

Ставки Live

В лайве «Леон Бет» охвачено меньше спортивных событий по сравнению с прематчем, но насыщенность линии остается достаточной. При этом нередко в онлайне появляются пари на региональные и молодежные первенства, на которые нельзя поставить до начала поединка.

Подробнее Свернуть

7/10 Superbet

7.8/10 Игроки

Ваша оценка

Live-роспись в LeonBets довольно глубокая, причем это мало зависит от значимости турнира. Так, даже на женский чемпионат Алжира по футболу можно увидеть свыше 200 рынков. Примерно такая же ситуация наблюдается с хоккеем, но в теннисе и баскетболе маркетов значительно меньше — обычно не более 100.

Live-ставки на футбол в «ЛеонБетс»

Практически все live-события сопровождаются инфографикой, но онлайн-трансляций в букмекерской конторе нет (не считая редких киберспортивных стримов). Однако все же лайв «ЛеонБетс» оставляет хорошее впечатление — наряду с подробной росписью букмекер предлагает приемлемую маржу, своевременное обновление котировок и минимальные задержки при заключении пари.

Бонусы

Букмекер LeonBets всегда выделялся выгодной бонусной программой для всех клиентов, а в 2021 году акций и подарков здесь стало еще больше. Не остались без внимания не только бетторы, но и игроки онлайн-казино.

Подробнее Свернуть

8/10 Superbet

7.8/10 Игроки

Ваша оценка

Букмекер традиционно предлагает или бонус за первый депозит, или фрибет для новых игроков. Стандартные условия отыгрыша депозитного бонуса –- около 20х. Может предлагать и набор фрибетов. Причем подобные предложения зачастую доступны и для постоянных игроков.

Также у LeonBets есть программа лояльности с начислением бонусных очков-леонов за любые выигрышные и проигрышные ставки. Обменивать леоны на реальные деньги можно в личном кабинете. Если описывать суть бонусной программы в двух словах — это примерно 1%-ный кэшбек со всех пари.

Вдобавок к этому ЛеонБетс ежемесячно проводит акции, розыгрыши и турниры среди игроков онлайн-казино, лайв-казино и BetGames. Ознакомиться со всеми предложениями букмекера можно в разделе «Акции».

Мобильное приложение

1/10 Superbet

Ваша оценка

Регистрация

1/10 Superbet

Ваша оценка

Платежи

— удовлетворительно

Количество доступных платежных методов в БК ЛеонБетс для счетов в белорусских рублях невелико. Однако базовые варианты депозитов и пополнений имеются. А если открыть счет в российских рублях или долларах, способов платежей станет намного больше — но среди них нет банковских карт.

Подробнее Свернуть

5/10 Superbet

9/10 Игроки

Ваша оценка

Для депозитов можно использовать банковские карты Visa и MasterCard, а также криптовалюты Bitcoin, Ethereum и Tether. Вывод возможен только на платежные карточки.

Зачисление денег с банковских карт производится моментально, в случае криптовалютных кошельков ожидание может занять до 15-30 минут. Вывод — от 1 часа до 3 дней (но обычно в течение суток). Комиссия со стороны букмекера при депозитах и кэшаутах отсутствует.

Личный кабинет

1/10 Superbet

Ваша оценка

Дизайн сайта

Удобство взаимодействия с официальным сайтом, игры на ставках и других действий в LeonBets оставляет положительное впечатление. Букмекерский портал имеет понятный интерфейс, «правильное» расположение элементов и хорошее быстродействие.

Подробнее Свернуть

10/10 Superbet

8.8/10 Игроки

Ваша оценка

На главной странице официального сайта отображается линия ставок на популярные предстоящие события. В верхней части экрана расположены кнопки перехода в другие игровые разделы, а в левой — виды спорта и киберспорта для пари. Есть поиск, избранное, выкуп ставки, автопринятие купона, сортировать события. Темный фон можно сменить на серый.

Дизайн сайта БК Leon bet

Практически аналогичный ресурс имела и БК «Леон» Беларусь, которая прекратила деятельность в конце апреля 2021 года.

Почему закрылась БК Leon.by

Хотя белорусская букмекерская контора Leon.by не объявила официальной причины своего закрытия, однако очевидно, что всему виной стали ужесточения в местном законодательстве. Дело в том, что с 1 апреля в силу вступил новый закон относительно регулирования деятельности букмекеров в РБ — легальные белорусские букмекерские конторы должны иметь лицензию с пунктом о «содержании виртуального игорного заведения».

Ни один местный букмекер не имел подобной лицензии — почти все компании попросту остановили свою деятельность с 1 апреля (без всяких шуток). Однако затем многие БК переоформили собственные лицензии должным образом и заработали снова, например, Париматч и Фонбет. Другие же компании ушли с белорусского рынка — таким образом и поступила официальная БК Leon.

Большинство клиентов закрывшегося белорусского букмекера перешло на его оффшорную версию — LeonBets. У нее есть несколько преимуществ перед официальной компанией: более простая регистрация и верификация, большее количество доступных валют счета и отсутствие автоматического вычета 4%-ного подоходного налога с выигрышей.

Как попасть на зеркало LeonBets

Официальный сайт ЛеонБетс блокируется в Беларуси — у букмекера нет лицензии от Министерства по налогам и сборам РБ на осуществление игорной деятельности. Поэтому этот букмекерский ресурс блокируется провайдерами, но обойти эти ограничения просто.

Зеркало LeonBets.com — точная копия основного сайта букмекера, которая работает на измененном домене. За счет этого оно открывается в обход любых блокировок. Линия ставок, роспись, личный кабинет и прочие параметры на зеркале полностью идентичны. Найти рабочее зеркало ЛеонБетс можно несколькими способами:

- Обратившись в службу поддержки БК по электронной почте [email protected] с соответствующей просьбой;

- Используя Телеграм-бота @Leonbets_bot, который всегда показывает актуальную ссылку на зеркало «ЛеонБетс»;

- Введя одноименный запрос в поисковой выдаче и перейдя по одной из открывшихся ссылок.

Актуальное зеркало LeonBets

В последнем случае стоит быть осторожным — некоторые мошеннические сайты могут маскироваться под зеркало БК «Леон». Если вы знаете, как выглядит настоящий ресурс букмекера, отличить его от фейкового портала не будет сложно.

Больше способов попасть на сайт

Зеркало BK Leon — не единственный вариант входа на официальный сайт букмекера в Беларуси. Для этого также можно использовать:

- VPN-программу — изменяет настоящий IP-адрес пользователя для доступа к заблокированным в стране сайтам;

- Proxy-сервер. Подключитесь к Прокси или введите вручную в настройках браузера;

- Анонимный браузер TOR — работает на условиях полной анонимности пользователей и открывает любые сайты;

- Веб-анонимайзер — позволяет переходить почти на все ресурсы анонимно и без блокировок (не требует установки).

Однако мы рекомендуем использовать зеркало «Леон» — для доступа к сайту подобным способом не нужно загружать сторонний софт. А вдобавок к этому зеркало исключает совпадение IP-адресов (если два пользователя БК подключились к одному VPN и зашли в личный кабинет, за это можно получить блокировку аккаунта).

Зеркало для мобильных устройств

Все перечисленные варианты поиска рабочего зеркала LeonBets актуальны и для мобильных устройств. Однако обладателям смартфонов на Андроид в этом отношении может быть еще проще — у букмекера есть мобильное приложение, которое открывается без блокировок. Кстати, здесь можно получить 5 фрибетов по 500 рублей и 50 фриспинов без депозита просто за установку софта. Мобильную программу ЛеонБетс можно скачать с официального ресурса букмекера, ее системные требования минимальны — Андроид 5.0 или новее.

Заключение о букмекере от Herobet.by

Букмекерская контора «ЛеонБетс» предлагает белорусским игрокам привлекательные условия ставок с одними из лучших котировок на рынке, вариативной росписью и щедрыми бонусами (в том числе и бездепозитными). А если добавить к этому качественный лайв, хорошую проработку киберспорта и множество других азартных игр, то получится попросту универсальный игорный продукт для бетторов, геймеров и гемблеров.

Однако стоит отметить и минусы этого букмекера — возможные трудности с выводами крупных сумм, малое количество способов платежей для счетов в белорусских рублях и отсутствие онлайн-чата. Впрочем, все это не так критично: играть в LeonBets можно.

Участники получат фрибеты в течение 5 рабочих дней с момента определения победителей.

Контракт с «Леонбет» будет действовать с 2022 по 2025 год. За это время будут проведены около тысячи профессиональных футбольных матчей в более чем ста турнирах. В нейминг и логотип Первой лиги будут внедрены спонсорские элементы, а игры и другие события, происходящие во время турниров, будут брендироваться айдентикой нового титульного спонсора.

Набрав 10 000 леонов, клиент вправе вывести их с накопительного бонусного счета на основной по курсу 2 леона = 1 рубль.

Вопрос решен, жалоба закрыта.

После выполнения всех требований отыгрыша букмекер переведет кэшбэк на основной счет клиента. Полученные средства можно будет использовать для других ставок или вывести их с игрового счета.

Российская лицензированная БК Леонбет не занимает лидирующие позиции в рейтинге букмекеров, бренд недостаточно раскручен. И все же ее .

В чатах про ставки на спорт игроки обеспокоены ситуацией и спрашивают, что же случилось:

Количество просмотров: 200

У Вас тоже проблемы с » леонбетс «? Бесплатно задайте вопрос юристам и получите ответ через 15 минут!

Задать вопрос »

Leonbets registration is a simple procedure that can be performed in a few easy steps. Here’s a step-by-step guide to signing up with Leonbets:

Игровые события в мобильных приложениях поделены на две вкладки — «Линия» и «Лайв». Есть фильтр по видам спорта с указанием числа событий, вкладка «Результаты», полноценный поиск и функция «Избранное».

Идентификацию через QIWI-кошелек можно пройти в салонах связи «Евросети», при себе необходимо иметь паспорт, а оплата такой услуги обойдется вам в 50 рублей. Через несколько часов статус кошелька обновится до максимального «Профессиональный». Если же вы имеете полностью верифицированный кошелек, то повторное прохождение не потребуется.

By collecting user data, Leonbets undertakes to store it and be responsible for its security. We must use all tools to completely eliminate the risk of third parties obtaining personal data about our users.